On Time Wealth Capital Funding Scenarios

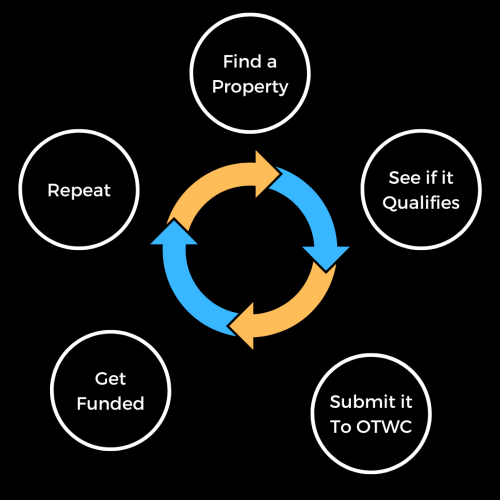

Designed by people who love real estate funding – for people who love to get funded. It’s so simple:

Use any of the 10 built-in Loan Qualifiers to see if your deal meets lender criteria for funding. Designed with the latest lending parameters and updated regularly, the loan qualifiers use proprietary algorithms to help you quickly answer the question – “Is this a deal that I can get funded?”

Our goal is to provide real estate investors, commercial mortgage brokers, real estate brokers and other industry professionals a simple, easy-to-use tool to understand quickly if a deal will likely get funded. Click the tabs below to learn how to choose the right single-family residential, multifamily, and commercial property qualifier.

SFR Loan Qualifiers

For Single Family, Duplex, Triplex, Fourplex

Condos & Townhomes

Multifamily / Apartments (5+ Units)

Loan Qualifiers

Commercial Property Loan Qualifiers

Including Office, Medical, Retail, Industrial, Warehouse, etc.

Short-term commercial property loans to complete improvements to attract tenants, increase occupancy and improve rental income. Upon completion the property is either sold or refinanced into a long-term rental loan.

For investors looking to close quickly - whether purchasing or refinancing. Commercial bridge loans are short-term loans used for rehab or for properties that don't qualify for traditional funding due to low occupancy, weak financials, or poor borrower qualifications.

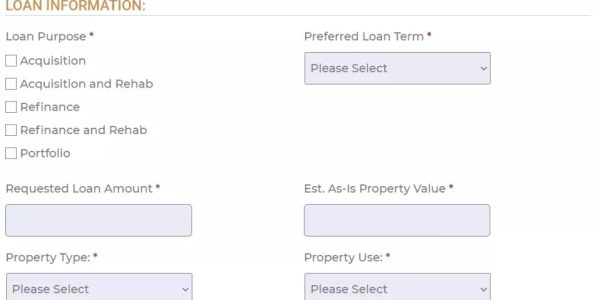

When you’ve found a property that qualifies for funding, you can submit your deal right from the website. Fill out the loan prequalification form and click “Submit”. It’s as simple as that!!

As always, every loan still goes through the full underwriting process to obtain a loan commitment. And, in the spirit of full transparency, there may be other factors that cause a deal that appears promising to be denied. However, the “Loan Qualifiers” on the website will get you over many of the initial underwriting hurdles.

And, if for some reason your deal doesn’t qualify, the website will tell you why. Often it’s as simple as bringing in a credit partner or maybe you need a bridge loan, rather than long-term financing.

Need business financing. We can help with that, too. Submit your request right from the website and we’ll help you get an SBA loan that works for your business!

When you’re on a walk-thru, just enter the property details on the spot to see if the property qualifies for funding! You can even prequalify deals before spending time on site visits.

Have your next investment property identified – great! The website will tell you if it’s likely to get funded. Don’t have a specific property in mind, that’s okay, too. You can connect easily to your favorite property websites with direct links in the app to find your next deal!

If you are a commercial mortgage broker, a big key to your success is focusing your time and energy on the loans with the greatest chance of successfully closing. Use the On Time Wealth Capital website to help you better qualify potential loan transactions. And, when you’ve got a deal that qualifies, work with On Time Wealth Capital to help you get it funded!

Join the On Time Wealth Capital Network of Brokers – You will be given direct access to input your loan into the On Time Wealth Capital loan portal. Designed specifically for Commercial Mortgage Brokers – getting loans closed with On Time Wealth Capital has never been EASIER or FASTER. Call Today: 1-888-760-2140

On Time Wealth Capital Cares: For Churches & Non-Profits

On Time Wealth Capital was founded in 2022. Our mission of service, we are proud to have assembled a team of providers to offer a suite of financial services designed to help churches & non-profits increase donations, grow their donor base, and expand their engagement within their organization. This system has been used by over 1,000 churches!

Often, our most important and personally gratifying work is not done in the office or on the job, but through our community service activities. Let On Time Wealth Capital help you maximize the capability of your organization to do great things within your community!

Information is available on our website.